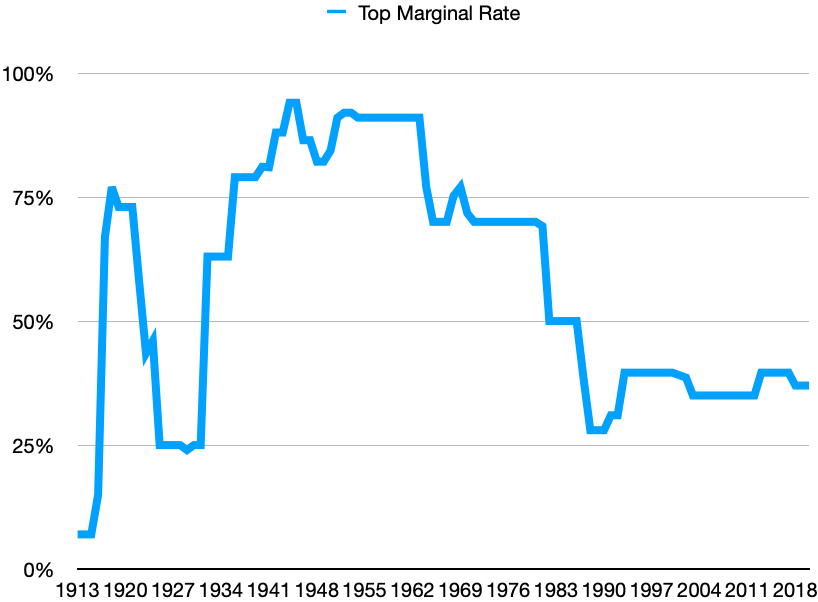

When looking at taxes, and how much you will have to pay, it helps to look at the long (and admittedly very boring) history of taxes in the U.S:

- When the 16th Amendment came about in 1913, the United States gave the federal government the ability to tax citizens of the country “without regard to any census or enumeration”. Thus, the income tax was born: with a whopping 7% charged on all income over $500,000! (over $13Million in income today)

- Shortly after this amendment came into effect, the US began participating in what would become known as World War I. The highest income tax bracket catapulted to 77% by 1918. After the war, the rates on the highest income earners settled down to 25% for the rest of the 1920’s. (Still more than triple the rate from 10 years prior)

- The U.S. economy began to falter after the “Roaring’ 20’s” and we entered the Great Depression, where tax rates went from 25% to 63%. Many permanent programs began to come into existence, which required more tax revenue. President Roosevelt pledged support for the Allies in World War II, and the top tax rate was raised all the way to 94% on all income over $200,000 (almost $3Million in income today).

- Throughout the 1950’s, 1960’s and 1970’s, the tax rate never dropped below 70%.

- President Reagan steadily dropped the tax rates in the 1980’s to a low of 28%. Not only that, but President Bush (the first) actually promised that 28% would be the highest income tax rate in a speech that would haunt his administration: “Read my lips, no new taxes”.

- The highest tax rate then rose to 39.6% in the 1990’s, and has hovered between 35% and 39.6% until today, where it sits at 37%.

PHEW! Now that that’s over, let’s see how this affects you and how to hopefully not overpay your taxes. The single biggest complaint I hear from clients is about the amount of taxes they end up paying. However, when we look at tax rates up above, we are actually at a historical low point! How can this be?

First of all, taxes in the US are progressive. Basically, if you make more money, you pay more in taxes, and your tax rate continuously increases. A young couple making $80k per year is in the 12% tax bracket for 2020, yet if they were to receive a bonus of just $250, they would now find themselves in the 22% tax bracket. WHAT A JUMP! If those clients met with a professional, they could work together to try and avoid this tax pitfall. (See how to use tax bracket planning)

Secondly, how you look at tax planning should continue to evolve due to changing rates and laws. Uncle Sam raises rates to increase revenue (most likely for added social programs or defense spending). As federal spending continues to increase, and with tax rates at recent lows, most economists agree that tax rates in the future have nowhere to go but up. Add to that the record levels of debt taken on due to COVID19, and we may be looking at a “taxageddon”. You should take all of this into consideration when saving for something down the road like retirement. If taxes are likely to go up when you retire, does it make sense to “max out” your 401k plan? Maybe you should also be contributing to a Roth plan to hedge against tax uncertainty. A tax advisor or a financial planner should be able to run through the numbers with you to see if this makes sense. (Even high income earners can use this backdoor Roth strategy)

Finally, something as simple as updating your W4 withholding form can make all the difference to whether you will owe next year. When the new tax laws went into effect, it reduced the amount withheld on many paychecks, because there was such a dramatic shift in tax brackets. So while you may (or may not) have a seen a higher take-home number on your paychecks, more money may need to be withheld.

Tax planning is complicated, and will only get worse with time. The instructions in 1913 were 4 pages, while it’s up to 108 today! You need to be aware of continuous changes to tax laws, and how they may affect your situation in any given year. You should also consider reaching out to a professional with a focus on tax planning, because after all, it isn’t how much you make: it’s how much you get to keep. We take a comprehensive approach to financial planning where we take the time to understand your individual circumstances so that we can assist you in your planning. Start planning smart, and stop being the government’s personal piggy bank.